Pan Xin: God predictions and some reflections on Drip + Uber

Lei Feng Network (search "Lei Feng Net" public concern) by: Author of this article Pan Xin, New Oriental Online COO.

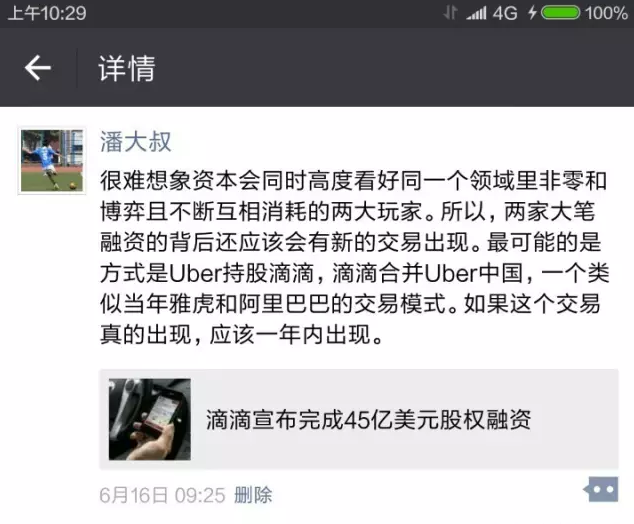

A month and a half ago, the author sent a circle of friends and predicted that if there was a transaction between Didi and Uber, it would appear within a year. Now the deadline node of this year advances to the first day of August... At the same time as the prediction of this god, the author brought some thoughts.

1, a month and a half ago, I used to make the above forecast. Based on the competition between the past and the fast, the pace of financing and the timing of the merger; based on Yahoo's and Alibaba's trading model of the past; also based on the non-zero-sum game model of the travel market, making this prediction itself is not difficult. I believe many people can think of it, but I happened to say it. Several media asked me to analyze why I made such a prediction. In fact, it is such a simple logic. At last, I took my head and made a circle of friends.

2. If this outcome is predictable, then believe that both Didi and Uber, as well as their major investors, all want it. If you want to get this result, then why do you have to burn so much money in the Chinese market? The market share corresponds to the valuation, and the valuation corresponds to the stakes in the merger. I once mentioned in my article on the thinking of the American Mission that “the competition in the Internet has now become a war on the ground, killing people who deserve to live and fighting and marrying. There will be more and more mergers and acquisitions in the future. Of course, the premise is that for start-ups, you have to fight undead." The same is true for the burning of money between Didi and Uber China.

3, Didi's official press release, my first reaction was exactly the same as that of Ali’s press release when Yahoo invested in Alibaba. In that year, how many times I read the news, I mistakenly thought that Ali bought Yahoo China and made a billion dollars. Now, how many times you read it will also be thought to be the acquisition of Uber China. Of course, they say so, you really can not pick any reason, this is the charm of Chinese characters.

4. The cross-holding business between Didi and Uber Global cannot actually be defined by the term "merger and acquisition". It can only be integration. Obviously, Uber holds more shares in Didi, which is also the associated condition for the integration of Uber China into Didi. The most intriguing news release is actually "Uber holds a 5.89% stake in Didi, which is equivalent to 17.7% of economic interest." Again sigh, the charm of Chinese characters. In comparison with Uber’s official press release: After the merger, Uber will become the largest share-holder in Didi. The Chinese ride-hailing company will also invest $1 billion in Uber as part of the deal, a person familiar with the matter said .

5. What happens after the drops and Uber China merge? From the press release, the team should still be independent. If the memory is not bad, then the merging team is breaking up and restructuring, so Uber China should not disappear as quickly as possible. But how long it can survive depends on how internal resources and funds are allocated.

6. To be honest, if the products and positioning of convergence (Uber China has not established a brand image matching its global brand), there is really no need for independent survival. If we want to achieve a healthy internal competing relationship, Uber China can only take the differentiation route. Differentiated, you can let one of them go against China, and continue to fight for a subsidy-consuming war. The other one can start earning money. Of course, the two mergers not only can reduce subsidies, but many of the costs can be reused or directly reduced. It is certainly helpful for the two companies to reduce the speed of burning money.

7. Of course, this is only theoretical. In fact, as a non-zero-sum game market, it is difficult for the travel market to completely consume dead opponents . The related issue is the so-called anti-monopoly issue. This is basically nothing. After all, the travel market is too big, and the criteria for how to define it are different. Didi and Uber are easy to explain. The definition of the travel market for the share of the two fights and the current definition of the two mergers for the approval of the travel market are definitely different.

8. The reduction in subsidy price increases after the merger of UDT and Uber is expected, but it is not necessarily sustainable. After all, there is also the opportunity to enjoy music at the bottom of the pocket and China's valuation of billions of dollars is waiting to see it. Therefore, for consumers in some cities, although the merger of Didi and Uber is bad, there should be other options. Of course, for consumers who are easy to come to cities that are not covered by China, it would be tragic. I hope you can stop taxis on the street there.

9. Previously considered the bilateral customer problem of the demand and supply of the business model. Didi's incremental market based on the taxi market, which is the stock market, has indeed increased the valuation and imagination. However, for demand-side consumers, there are strong alternatives between various modes of travel, which in turn leads to strong competition among multiple suppliers on the platform. This is also the reason for the frequent occurrence of DJ and Uber driver incidents. The merger also does not seem to solve the root cause of the contradiction, and this contradiction plus the subsidy factor will continue to cause drivers to move back and forth across the various platforms.

10. The coincidence between the launch of the New Deal about the New Deal and the Uber incident on the Internet also has the inevitable consequence of the policy itself. It is believed that both Didi and Uber learned the content of the New Deal about the Internet earlier than we did. Reducing one competition will reduce the possibility of a conflict with the New Deal. At the very least, the integration of the two parties is in line with the orientation needs of the New Deal about the car. For the transportation sector, managing a giant taxi company is easier than managing two big taxi companies. From this point of view, the future of the network about the car policy will be more inclined to tilt or listen to their voice Uber, easy to reach in this regard and China will certainly suffer some.

11, a lot of people say that Uber is one side of Liu Ping Liu Yan, so they are Liu's. I think it's quite nonsense. I suggest you take a little look at their respective shareholder structure . Of course, if one day, China is integrated into Uber, then you can further conspiracy theory.

12. In the end, it is strongly recommended that Yiyi and Shenzhou start the Huimin operation with a charge of 100 to 250 as soon as possible. The machine cannot be lost.